Related Media

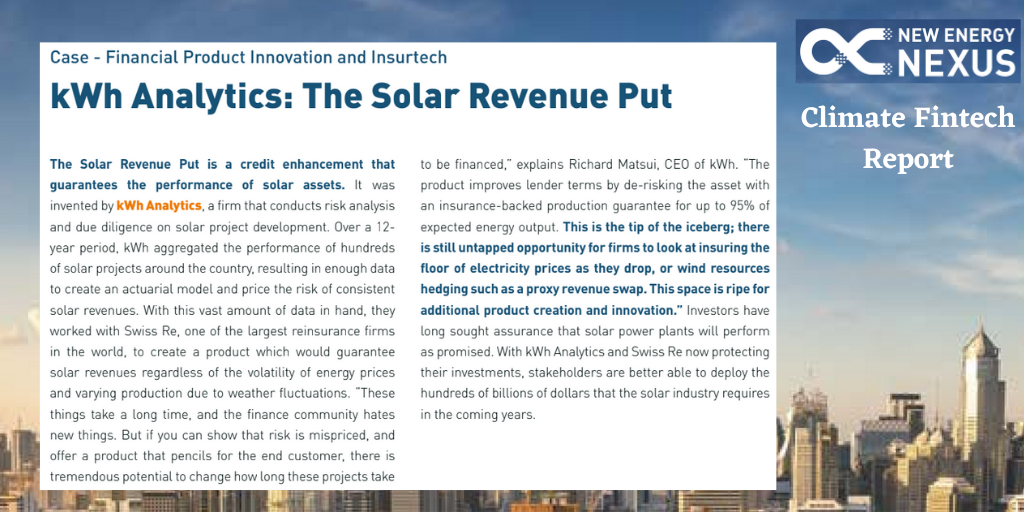

The Solar Revenue Put has become a market standard solution for sponsors seeking to optimize their financial returns, ranging from thousands of residential rooftop power plants to utility-scale solar farms.

kWh Analytics, along with Munich Re and MUFG, have just closed on a groundbreaking new structure - the Wind Proxy Hedge structured with the kWh Analytics “Indifference Structure” - for a 59 MW wind project in Maine, developed by Greenbacker Capital Management. Notably, the Wind Proxy Hedge creates a floor on revenues tied to a lack of wind resource and provides lenders with additional cash flows when considering downside debt sizing cases.

In this episode of The Solar Podcast, Alex Deng, Director of Business Development, joins host Dave Anderson to lift the veil on solar project finance and insurance, explaining the key but unseen role insurance plays in getting renewable energy projects built.

The Solar Revenue Put has now been structured on $1B of solar capacity.

The Solar Revenue Put is revolutionising solar market transactions.

Falling interest rates are creating an opportunity for many renewables developers to squeeze more money out of operating assets.

kWh Analytics, the market leader in solar risk management, today announced the first contract for differences (“CFD”) supported by the Solar Revenue Put.

See Bloomberg for original post by Brian Eckhouse.

kWh Analytics, the market leader in solar risk management, today announced the first refinancing supported by the Solar Revenue Put.

kWh Analytics announced it has structured its Solar Revenue Put credit enhancement on over $500 million of solar assets.

Swiss Re Corporate Solutions has provided the risk capacity for a so-called Solar Revenue Put

kWh Analytics has structured its Solar Revenue Put for a portfolio of 4,000 residential systems totaling 35 MW-DC, insuring the long term production of the portfolio to ease investor’s worries.

SAN FRANCISCO – kWh Analytics, the market leader in solar risk management, today announced that it structured a Solar Revenue Put for a portfolio of 4,000 projects totaling approximately 35 MW DC

SAN FRANCISCO – kWh Analytics, the market leader in solar risk management, announced today that it has structured its Solar Revenue Put credit enhancement on over $250 million of solar assets.

An Ares EIF-backed residential solar portfolio has closed financing with a term loan from ING Capital and a solar revenue put with Swiss Re.

A tool designed as an insurance policy for solar-power generation will be used to manage the risk associated with U.S. residential systems for the first time