Jason Kaminsky, CEO, kWh Analytics

I recently had the opportunity to participate in an Insurance 101 Webinar hosted by Solarplaza, with co-panelists Lindsey Chang of Marsh, and Jaime Carlson of SB Energy. Insurance continues to be an enigma in the renewable energy industry, albeit an increasingly important one. We wanted to provide some global context for understanding the space and the pivotal role insurance can play in financing and protecting your assets.

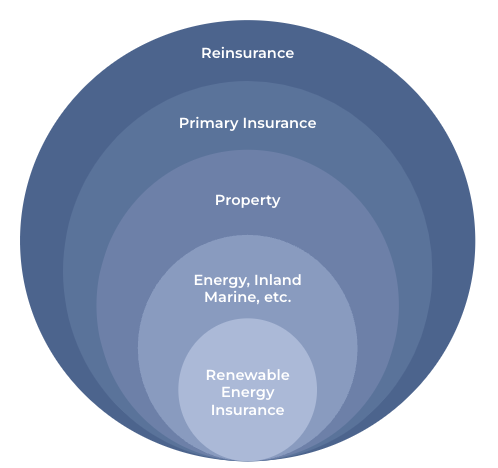

The value chain of insurance typically flows from the client or sponsor, like SB Energy, through brokers, like Marsh, and then finally to the insurance carrier. You can also have managing general agents who help carriers understand and underwrite risk, and that is where kWh Analytics falls. Renewable Energy insurance is impacted by the entire (re)insurance ecosystem; it typically sits within a carrier’s Energy/Inland Marine book, which is within a Property insurance book. The carrier then buys reinsurance across multiple lines of business, which is essentially insurance that insurance companies purchase. Reinsurance typically renews on January 1, and this year’s renewals proved to be especially difficult. If you’ve followed the news, you’ll know that there were significant natural catastrophe losses in the past year. Reinsurance rates have shot up across many insurance types, particularly for natural catastrophe coverage, and the end clients and sponsors are feeling the effects in all lines of business, including renewables.

Since renewable energy is still a newer asset class, there are few underwriters and agencies with the expertise and specialization to truly understand the nuances and risks associated with solar panels, wind turbines, and storage. Believe it or not, some underwriters are still using the ‘tin roof’ model for solar, underwriting these assets as if they were a tin-roofed storage shed. There are a few criteria that underwriters should be looking at when assessing a project:

attritional risks, such as the chance of inverter failure, vandalism, etc

natural catastrophe risks like wind, hurricane, earthquake, fire, and flood.

Natural catastrophe risks receive a lot of attention, and for good reason - such events have tripled in frequency in the past 50 years. These shocks to the system have caused the industry, and carriers in particular, significant concern when managing renewable energy. Major hail and hurricane events have resulted in outsized losses in carriers’ books, which are now passed onto end customers through higher premiums and tighter terms and conditions.

The good news is that there is a lot of innovation in renewable energy, particularly around data and resiliency. With more and better data entering the space, modeling and pricing have become more accurate. At kWh Analytics, we utilize the largest database in renewable energy operating assets to understand weather predictions, the frequency of natural catastrophe events, and the actual outcomes for the assets. Today, we’re having conversations about correct hail stow angles and vegetation management, topics that were not nearly as active even 5 years ago.

Pre-2019, insurance was abundant and asset owners could receive as much as they asked for. Between 2019 and 2022, outsized natural catastrophe losses catalyzed changing insurance terms, driving up premiums and driving down capacity, creating a difficult environment for insureds. Looking ahead, the key will be continued innovation and the further adoption of resilient practices. Sponsors can control some of their risk by diversifying their portfolio geographically, and ensuring that adequate operations and management protocols are in place for their sites. Insurance has become a crucial part of the development process and it’s important to understand it in a global context. Working with knowledgeable, specialized, and data-driven carriers will help unlock this lucrative form of capital for the renewable energy industry.

Thank you to Solarplaza for the opportunity to discuss renewable energy insurance on their platform. Check out the webinar here. Join us at Solarplaza Summit Asset Management North America this April in San Diego for further discussions on solar underproduction, mitigating natcat risks, and the future of solar insurance.

Sincerely,

Jason Kaminsky, CEO

kWh Analytics