SAN FRANCISCO--kWh Analytics, the market leader in Climate Insurance, today announced a partnership with Arava Power, Paz Oil and Menora Mivtachim to provide production insurance to optimize debt terms on a 270MWdc utility-scale solar project in Uvalde County, TX.

Arava Power, Paz Oil and Menora Mivtachim utilized the Solar Revenue Put from kWh Analytics to de-risk their solar investment in the United States and enhance the project’s financial success. The Solar Revenue Put is an insurance policy covering solar production to provide protection against downside risk. The policy allows asset owners to achieve more favorable financing terms via additional debt or optimized loan terms, providing sponsors with greater financial flexibility and stability.

“At kWh Analytics, our goal is to provide sponsors and lenders with the tools and resources they need to confidently invest in the renewable energy sector,” said Jason Kaminsky, CEO of kWh Analytics. “The Solar Revenue Put is a game-changer, offering an uplift in return on investment and reducing the risks associated with solar performance. We are thrilled to partner with Arava Power, Paz Oil and Menora Mivtachim on this venture, and are proud to be at the forefront of renewable energy investing in the US.”

Nomura led the debt financing as sole Coordinating Lead Arranger and Sole bookrunner, arranging an approximately $200 million senior secured credit facility on behalf of Arava Power, Paz Oil Ltd and Menora Mivtachim. This financing is a landmark transaction for the consortium with the project. Nomura assembled a syndicate of international lenders which includes Siemens Financial and BHI. Snapper Creek Advisors, a boutique energy advisory firm, is providing commercialization and financial consulting to the sponsors.

“We are proud to have achieved financial closing on the exceptional Project Sunray, together with our remarkable partners, Paz Oil and Menora Mivtachim,” said Arava Power CEO, Ilan Zidkony. “This Project represents the first step in our broader US expansion strategy, and we are honored by the trust and partnership of our financing partners – Nomura, BHI, Bank Hapoalim, and Siemens Financial who have helped us reach this important milestone. We were delighted to be able to work with kWh Analytics on this project, their support and professionalism were first-class, and we look forward to working together on future projects.”

“We are proud and satisfied to reach full financial close and start construction for this substantial and unique solar PV project,” said Hagai Miller of Paz Oil. “By mid-next year, we expect this project to be in full operation, producing enough electricity to power tens of thousands of households in the area. We would like to thank our excellent partners, Arava Power Company and Menora Mivtachim group and to our remarkable financing partners who put their trust in us and into this project – Nomura, Bank Hapoalim, and Siemens Financial.”

Vinod Mukani, Global Head of Nomura’s Infrastructure and Power Business (“IPB”) commented, “We are very pleased to leverage our global financial and intellectual expertise to provide a bespoke funding and financing solution to support Arava Power, Paz Oil and Menora Mivtachim as they enter the United States market. Providing superior execution in growing sectors, like renewable energy, for excellent Sponsors like these, aligns perfectly within Nomura’s business strategy and goals.”

“Nomura is excited to provide a unique financing package supporting the funding of this important project in the US for Arava Power, Paz Oil and Menora, who have talented teams and a compelling business strategy contributing toward the transition of low carbon economy,” said Alain Halimi, Executive Director of Nomura’s IPB. “We appreciate the support and creative approach from the kWh team assisting in enhancing the project’s structure and mitigating lenders’ downside risk.”

The United States has become an increasingly attractive location for international renewable energy sponsors, with growing demand for clean energy and a supportive regulatory environment. However, making long-dated investments in such a rapidly evolving industry can expose investors to risks. The Solar Revenue Put credit enhancement provides a solution for these risks by insuring the revenue generated, increasing investor confidence in renewable energy projects and their returns. This, in turn, helps to drive the growth of renewable energy and supports the transition to a clean grid.

ABOUT Arava Power

Arava Power Company (APC) is a solar Developer / IPP that pioneered utility scale photovoltaics in Israel; developing, owning and operating hundreds of megawatts over the past 15 years.

APC’s profound expertise and years of experience have allowed it to build one of the most profitable portfolios in the industry, maintaining and improving performance through excellence in development, technological innovation and advanced asset management operations.

Today, APC holds a multi-GW development portfolio in Israel and the U.S., across utility scale PV and BESS, Agri-Voltaics and Distributed Energy Systems.

Since the earliest days of the solar industry, APC has been at the forefront of the energy transition, delivering on the promise of clean, sustainable energy to power our planet’s future.

ABOUT Paz Oil Group (TLV: PZOL)

Founded in 1922 and based in Israel, Paz (TASE: PZOL; ilA+) is one of the largest energy companies in Israel, focusing mainly on fuel retail, LPG, real estate, food & convenient retail, renewables, EV charging.

Paz is a public company whose shares are traded in the Tel Aviv Stock Exchange, and it is listed on the TASE's flagships indexes, which tracks the shares of the companies with the highest market capitalization in the stock exchange.

Paz is the largest gas retailer in Israel with about 270 gas stations and convenience retail locations and more than 60 supermarkets in the center of the cities, which is one of the leaders in Israel. Further, Paz has annual revenue of 5.3$bn, total assets of 4.5$bn and a market capitalization of over 1.3$bn. Paz is currently increasing its dedication to the energy transition infrastructure sector by beginning to install EV charging stations to its existing convenience and gas stations, receiving licenses to supply electricity to a large share of households in Israel using its hundreds of thousands existing LPG clients alongside with using the company's knowledge for recruiting new clients, and through its acquisition of supermarkets, expanding its retail of food and energy business.

In the renewable sector, Paz Group is establishing a global RES activity focusing on utility scale solar, onshore wind and storage solutions in Europe/US and expand into neighboring countries. In Israel, Paz is focusing to become a customer-centric player in the IL electricity market by providing a variety of solutions to its customers, incl. energy and electricity, mainly to the Industrial, commercial and residential sectors.

The Group's financial resilience, combined with advanced work methods, a highly developed service orientation and the ability to zero in on marketing opportunities, have positioned Paz as one of Israel's top companies, with a reputation for professionalism and leadership.

More about Paz at https://www.paz.co.il/en-US/home

ABOUT Menora Mivtachim

Menora Mivtachim Holdings Ltd. is one of Israel's five largest insurance & finance groups. The group specializes in asset management, manages the largest pension fund in Israel – ‘Menora Mivtachim pension and gemel', and is the largest General Insurer in Israel and the market leader in Motor Insurance sector. The group operates through its subsidiaries, in all sectors of Life Insurance, Long/Mid/Short-Term Savings, General Insurance and Health Insurance. In addition, the group is active in the capital markets and finance sectors, including Mutual Funds Management, Financial Portfolio Management, Underwriting and worldwide real estate investments.

ABOUT Nomura

Nomura is a global financial services group with an integrated network spanning over 30 countries and regions. By connecting markets East & West, Nomura services the needs of individuals, institutions, corporates and governments through its three business divisions: Retail, Investment Management, and Wholesale (Global Markets and Investment Banking). Founded in 1925, the firm is built on a tradition of disciplined entrepreneurship, serving clients with creative solutions and considered thought leadership. For further information about Nomura, visit www.nomura.com.

ABOUT kWh Analytics

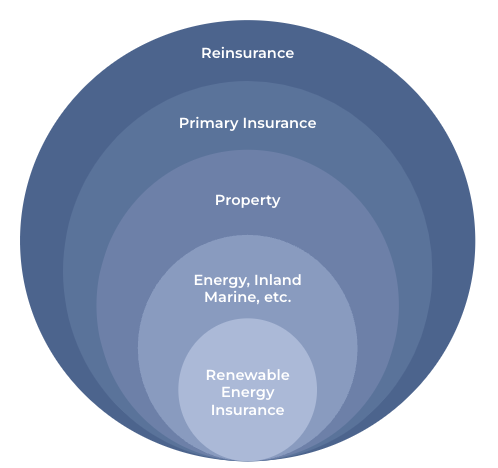

kWh Analytics is a leading provider of Climate Insurance for zero carbon assets. Utilizing their proprietary database of over 300,000 operating renewable energy assets, kWh Analytics uses real-world project performance data and decades of expertise to underwrite unique risk transfer products on behalf of insurance partners. kWh Analytics has recently been recognized on FinTech Global’s ESGFinTech100 list for their data and climate insurance innovations. The Solar Revenue Put production insurance protects against downside risk and unlocks preferred financing terms, and Property Insurance offers comprehensive coverage against physical loss. These offerings, which have insured over $4 billion of assets to date, aim to further kWh Analytics’ mission to provide best-in-class Insurance for our Climate. To learn more, please visit https://www.kwhanalytics.com/, connect with us on LinkedIn, and follow us on Twitter.

Contacts

Nikky Venkataraman

Marketing Manager

E | nikky.venkataraman@kwhanalytics.com

T | (720)-588-9361